The Bloomberg Kentuckiana index showed signs of area businesses recovering from the beating that they took following the stock market shakeup on news of Britain’s exit from the European Union – dubbed Brexit.

Stocks fell sharply across the board last Friday as investors heard news that leave votes had outnumbered remain votes, spurring uncertainty about currency valuations and changes to trade deals. Businesses tied to the Kentuckiana area did not escape the plunge.

The Bloomberg Kentuckiana Index is a price-weighted index that tracks companies either headquartered in Kentucky or Indiana, or having a large presence in the area. Each company has a minimum market capitalization of $15 million. The index was developed with a base value of 100 as of December 29, 1995. Index members include Kindred Healthcare, Humana, Churchill Downs, Lexmark, Ford, GE, Yum! Brands, Papa Johns, and Brown Foreman, among others.

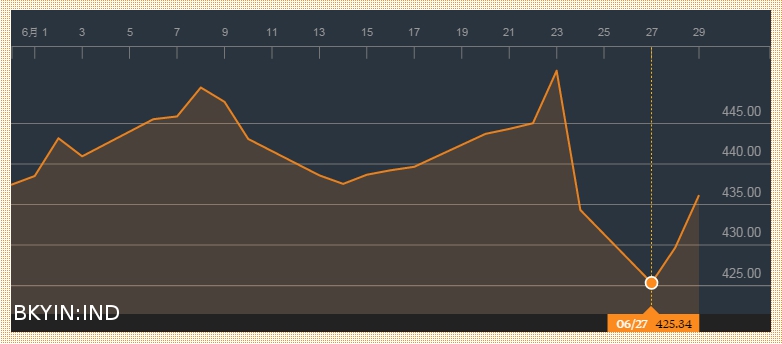

The index closed at its recent peak of $451.51 last Thursday but then dove sharply when the markets opened on Friday with Brexit news. The dive continued on Monday as the index bottomed out at $425.34, which was still higher than lows seen as recently as February of this year.

Investors seemed to have settled down Tuesday and Wednesday as the index rebounded, lead higher by gains by Kindred, Cummins, Churchill Downs, CSX, and Ashland. Although BKYIN:IND is not back to pre-Brexit levels, two straight gains of positive movement are promising as the index climbs into the $430s.

For more information on the Bloomberg Kentuckiana Index, track it here.

Weather

Weather Traffic

Traffic @LouisvilleDispatch

@LouisvilleDispatch @LouisvilleDisp

@LouisvilleDisp Subscribe

Subscribe

Leave a Reply